Snapchat’s Success Story & What Can Elon Musk Learn From It

Snapchat first came out over a decade ago; it was derided as little more than an adolescent talking app. Users’ popularity drove the most prominent tech market listing since Facebook. It was written off as a Wall Street flop within months. It is now in high demand. Its comeback has implications for Elon Musk’s imminent acquisition of Twitter. It was unclear if Snapchat’s parent company, Snap, existed a few years ago.

Snapchat first came out over a decade ago; it was derided as little more than an adolescent talking app. Users’ popularity drove the most prominent tech market listing since Facebook. It was written off as a Wall Street flop within months. It is now in high demand. Its comeback has implications for Elon Musk’s imminent acquisition of Twitter. It was unclear if Snapchat’s parent company, Snap, existed a few years ago.

Instagram has distilled its most outstanding features into a gleaming app with a billion users. Snap was losing money by early 2019. Shares were trading at a discount to their listing price two years earlier, and bets against the business increased. According to my estimates, it had around three years to turn things around before running out of money. Three years later, the firm has accomplished just that. It has enhanced its digital advertising business and strengthened its financial position. Because it focuses on small groups and private conversations, it has 100 million more users than Twitter. Its user base is expanding quicker than that of Facebook. Most importantly, it has regained favor among young people.

Suppose you are not a regular Snapchat user. In that case, you may be surprised to learn that in the United States, Snapchat has more Gen Z users in their teens and early twenties than TikTok, Twitter, Facebook, or Instagram, according to eMarketer statistics. The digital advertising business, which social media firms rely on, values that pipeline. The online age appears to prioritize privacy above continual public shows of popularity. The online age seems to prioritize privacy above continual public shows of popularity.

The same trend may be observed in other social media networks. Telegram and WhatsApp private groups are thriving. However, only a few friends still update public Facebook or Instagram postings. Evan Spiegel, Snap’s co-founder alongside Bobby Murphy, is now in his early 30s. That implies he is likewise too old for the Generation Z age group. When I asked him why he felt Snapchat had such a youthful following, he referred to private chats. “Bobby and I grew up in social media,” he explained. “I believe that connecting on Snapchat with folks you care about without vying for public likes and comments opens up a whole new channel for self-expression.”

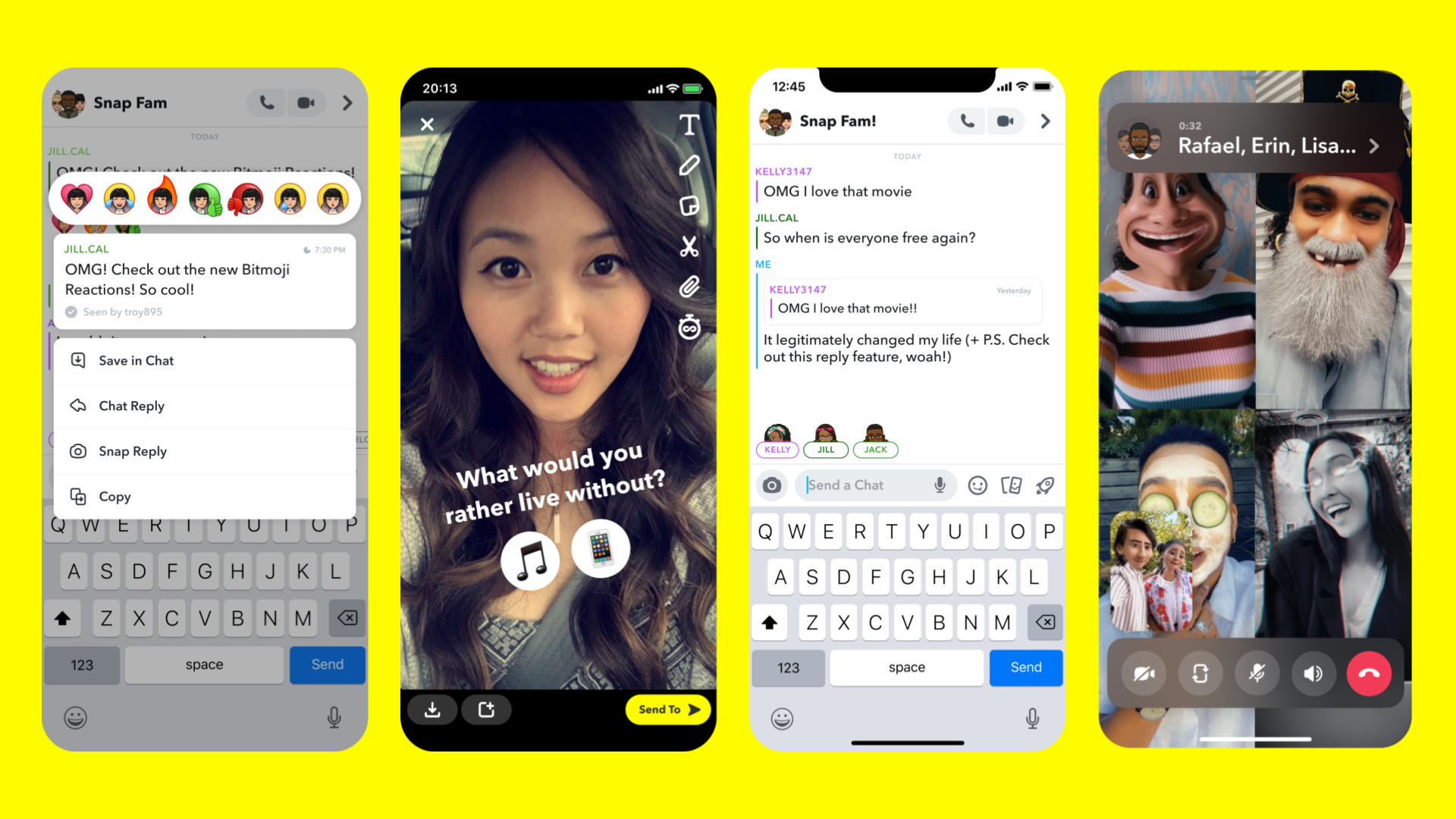

Twitter is testing a feature called Circles, allowing users to exchange tweets with a specific group of people. However, accumulating many followers remains the metric of success on the network. Snap refers to itself as a photography company even though it is most recognized for its social networking app. Snap’s appeal is due to more than simply private messaging. It has improved its Android app, sold just under $5 billion in convertible debt to establish a liquidity buffer, and developed fresh concepts to keep customers interested.

Snap refers to itself as a photography company even though it is most recognized for its social networking app. It is still obsessed with hardware, lately introducing the Pixy, a little yellow drone. It is currently losing money, though it is expected to profit this year. Like all social media firms, it has yet to find an effective means to earn money outside of digital advertising. As investor interest waned, Snap expanded its company while betting on an augmented reality future. It participates in business transactions while also investing in riskier ones. This year, it acquired the French start-up NextMind, which develops technology that allows users to manipulate virtual visuals with thinking. The value of experimenting without high investor expectations is maybe the most important conclusion from Snap’s turnaround. Musk may be able to do the same by taking Twitter private.